Taxes for Americans Living Abroad: FBAR, FATCA and IRS Rules

US Expat Taxes: What Americans Abroad Need to Know About Filing, Avoiding Double Taxation, and Staying Compliant with IRS Rules.

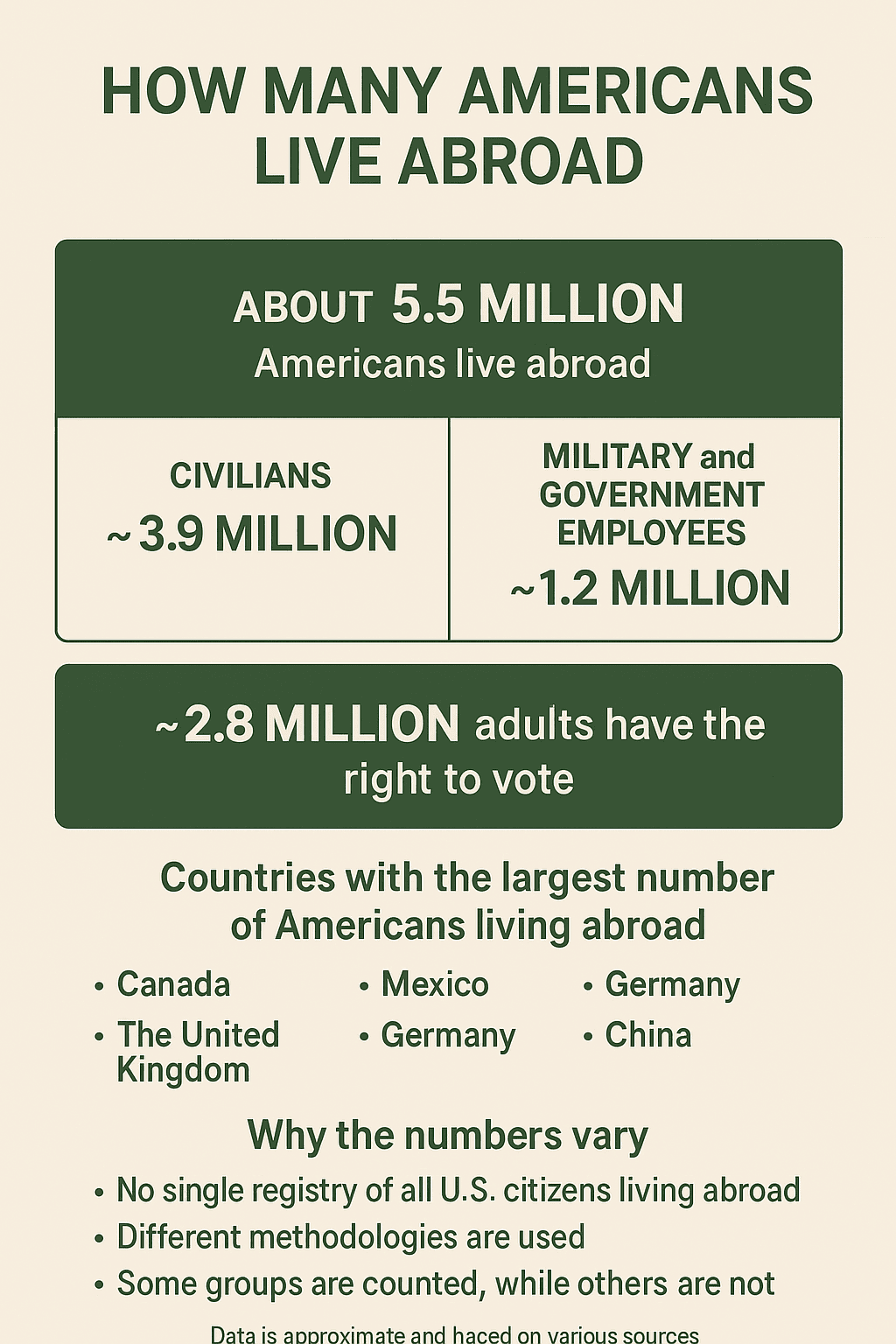

Living outside the United States can feel like freedom. New culture, new opportunities, maybe even lower living costs. But there’s one thing you cannot leave behind: US taxes. Unlike most countries, the United States taxes its citizens on worldwide income, no matter where they live. That means if you are an American abroad, you still need to file tax returns to the IRS every year.

For many expats this comes as a surprise. You may already be paying taxes in your new country and assume that is enough. But the IRS has very clear rules, and the penalties for ignoring them are high. This article explains the basics of US expat taxes, including the main forms you need, how to avoid double taxation, common mistakes people make, and why working with an expat CPA can save you money and stress.

Why Do Americans Abroad Still File Taxes?

The US is one of only two countries in the world that taxes based on citizenship instead of residency. So whether you live in Paris, Dubai, or Tokyo, if you have a US passport or a Green Card, the IRS expects a yearly tax return.

The rules apply even if:

You have not lived in the US for many years

You pay income tax in your new country

Your income is not from US sources

This system means Americans abroad taxes can be complex. It also means that many people accidentally fail to file. The IRS calls this expat filing requirements, and they are strict about compliance.

IRS Expat Filing Requirements

If your income is above the standard filing threshold (which changes each year), you must file a tax return with the IRS. This includes reporting:

Salary and wages earned abroad

Self-employment income

Rental income from property in the US or abroad

Dividends, capital gains, and other investment income

Even if all your income is from outside the US, you must report it.

On top of the regular tax return (Form 1040), expats often need to file additional forms such as:

FBAR (FinCEN Form 114) – if you have more than $10,000 combined in foreign bank accounts at any time during the year

FATCA (Form 8938) – if you hold foreign financial assets above certain limits (for example, $200,000 for singles living abroad)

Not filing these reports is risky. Penalties for missing an FBAR can be up to $10,000 for each year. In cases of willful violation, the fine can be 50% of the account balance. FATCA penalties start at $10,000 and can increase with time.

How to Avoid Double Taxation

A big concern for Americans abroad is double taxation. Paying income tax in your host country and then again to the US can quickly wipe out your earnings. Fortunately, the IRS offers tools to reduce or eliminate this problem.

1. Foreign Earned Income Exclusion (FEIE)

The FEIE lets you exclude a large portion of your foreign income from US tax. For 2024, the exclusion is around $126,500. To qualify, you must meet either:

The Physical Presence Test – living outside the US for at least 330 days in a 12-month period

The Bona Fide Residence Test – being a tax resident of another country for an entire calendar year

2. Foreign Tax Credit (FTC)

The FTC gives you a credit for taxes you pay to a foreign country. This prevents being taxed twice on the same income. If you live in a country with high tax rates, the credit often wipes out your US tax liability completely.

3. Tax Treaties

The US has tax treaties with many countries. These agreements can provide additional relief, especially for pensions, social security, or specific kinds of income.

Using FEIE, FTC, or a tax treaty correctly can save thousands of dollars, but the rules are tricky. Many expats try to claim both the exclusion and the credit incorrectly, which can lead to audits or penalties.

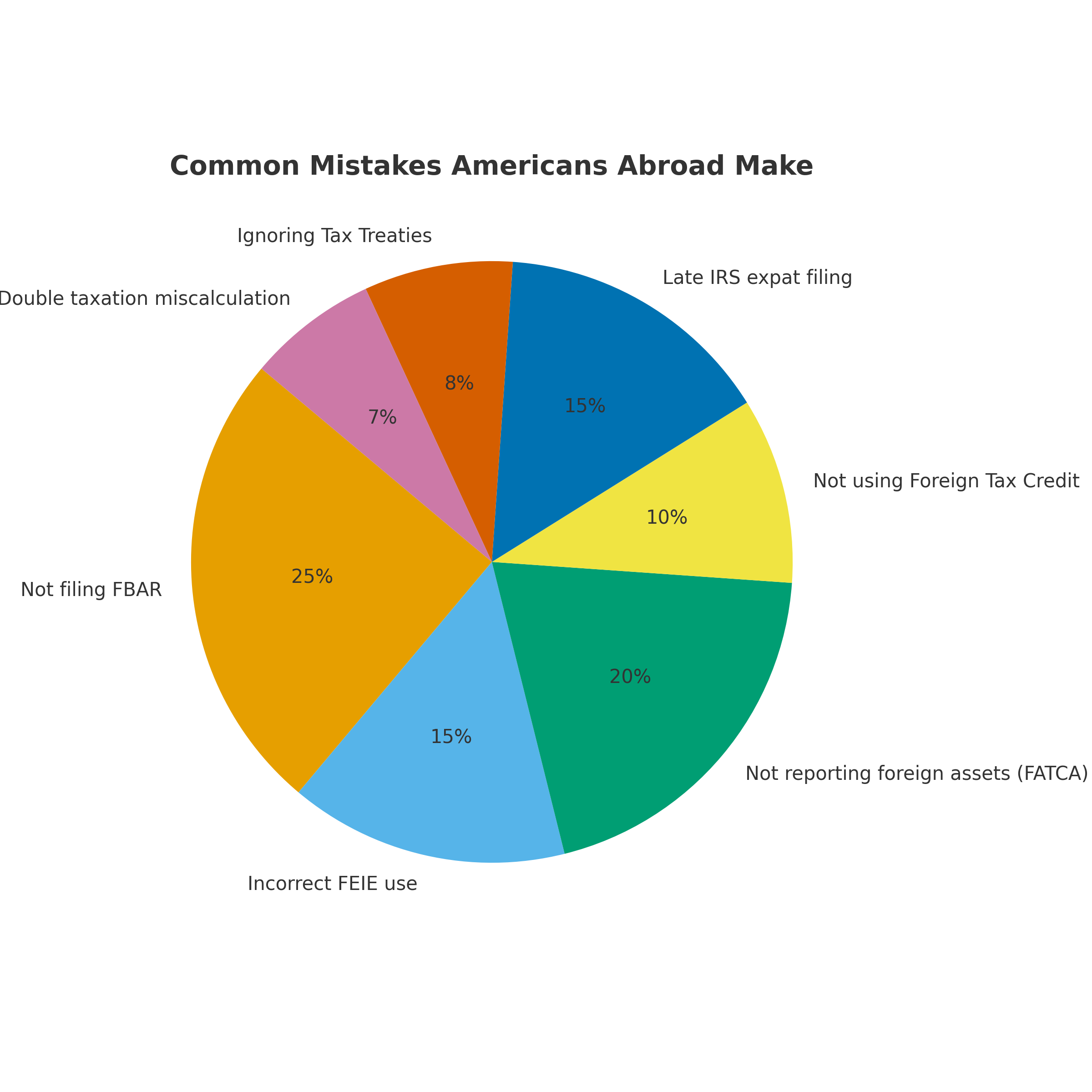

Common Mistakes Americans Abroad Make

Even smart, organized people make errors when it comes to expat taxes. Here are the most frequent ones:

Not filing at all

Many believe they don’t need to file since they pay taxes in their country of residence. This is false. The IRS requires a return from every citizen, regardless of where they live.Forgetting FBAR and FATCA

Reporting foreign accounts is one of the most overlooked parts. The penalties for missing these are some of the harshest in the tax code.Not claiming the right exclusions or credits

Some expats forget to apply FEIE or FTC and end up paying taxes they could have legally avoided.Misusing the Foreign Earned Income Exclusion

You must meet strict residency tests. Spending too much time in the US during a year can cancel your eligibility.Relying on tax software built for US residents

Many online tax filing programs are not designed for expat needs. They may miss forms like FBAR or fail to apply treaties correctly.Waiting too long to fix mistakes

The IRS offers programs for delinquent filers, such as the Streamlined Filing Compliance Procedures. But if you ignore the issue for too long, penalties pile up.

What Are the Penalties for Not Filing?

The IRS takes non-compliance very seriously, especially with foreign accounts. Some examples:

Failure to file a tax return: penalty of 5% of unpaid tax per month, up to 25%

Failure to pay tax: penalty of 0.5% per month, plus interest

FBAR non-filing: up to $10,000 per year for non-willful violations; for willful cases, up to 50% of the account balance

FATCA non-filing: $10,000 penalty, increasing to $50,000 if ignored

These fines can ruin finances. That is why compliance is not optional.

Why Work with an Expat CPA?

While some expats handle taxes on their own, the risk of mistakes is high. A professional expat CPA specializes in these situations. Working with one provides:

Correct use of FEIE and FTC to lower taxes

Accurate completion of FBAR and FATCA forms

Guidance on using tax treaties

Peace of mind that you are compliant with IRS rules

Most importantly, an expat CPA can help you plan ahead. Tax planning for Americans abroad is not just about filing forms. It is about structuring income, investments, and retirement savings in a way that reduces tax in both countries.

Taking Control of Your Taxes Abroad

Living abroad should be about opportunities, not tax stress. Yet thousands of Americans every year face audits, penalties, or unexpected bills because they didn’t understand the rules. US expat taxes are complex, but with the right guidance, they don’t have to be overwhelming.

If you are unsure about your situation, or if you have missed filings in the past, the smartest step is to talk with a professional.

Get Help from a CPA Who Understands Expats

Svetlana Gadzhieva, CPA, has years of experience helping Americans abroad manage their IRS obligations. She works with expats around the world to:

File back taxes and catch up with the IRS

Reduce tax bills using FEIE and FTC

Stay compliant with FBAR and FATCA rules

Avoid double taxation with the right treaty strategies

If you want peace of mind and a clear path forward, schedule a consultation with Svetlana Gadzhieva, CPA. A short call can save you thousands of dollars and prevent future headaches.

🌐 Website: gadzhieva.com

📧 Email: svetlana@gadzhieva.com

📱 Phone: (510) 974-3115

💬 Telegram: https://t.me/Svetlana_CPA

📸 Instagram: @gadzhievacpa

💼 LinkedIn: Svetlana Gadzhieva, CPA

📍 Based in California, available nationwide