Typical IRS Penalties and How to Avoid Them: Real Cases and Practical Advice

Why IRS Issues Penalties

The IRS applies penalties to encourage compliance. Penalties can be triggered by late filing, late payments, inaccurate reporting, or not filing required forms. These charges are common for both individuals and small businesses, and they grow quickly if ignored.

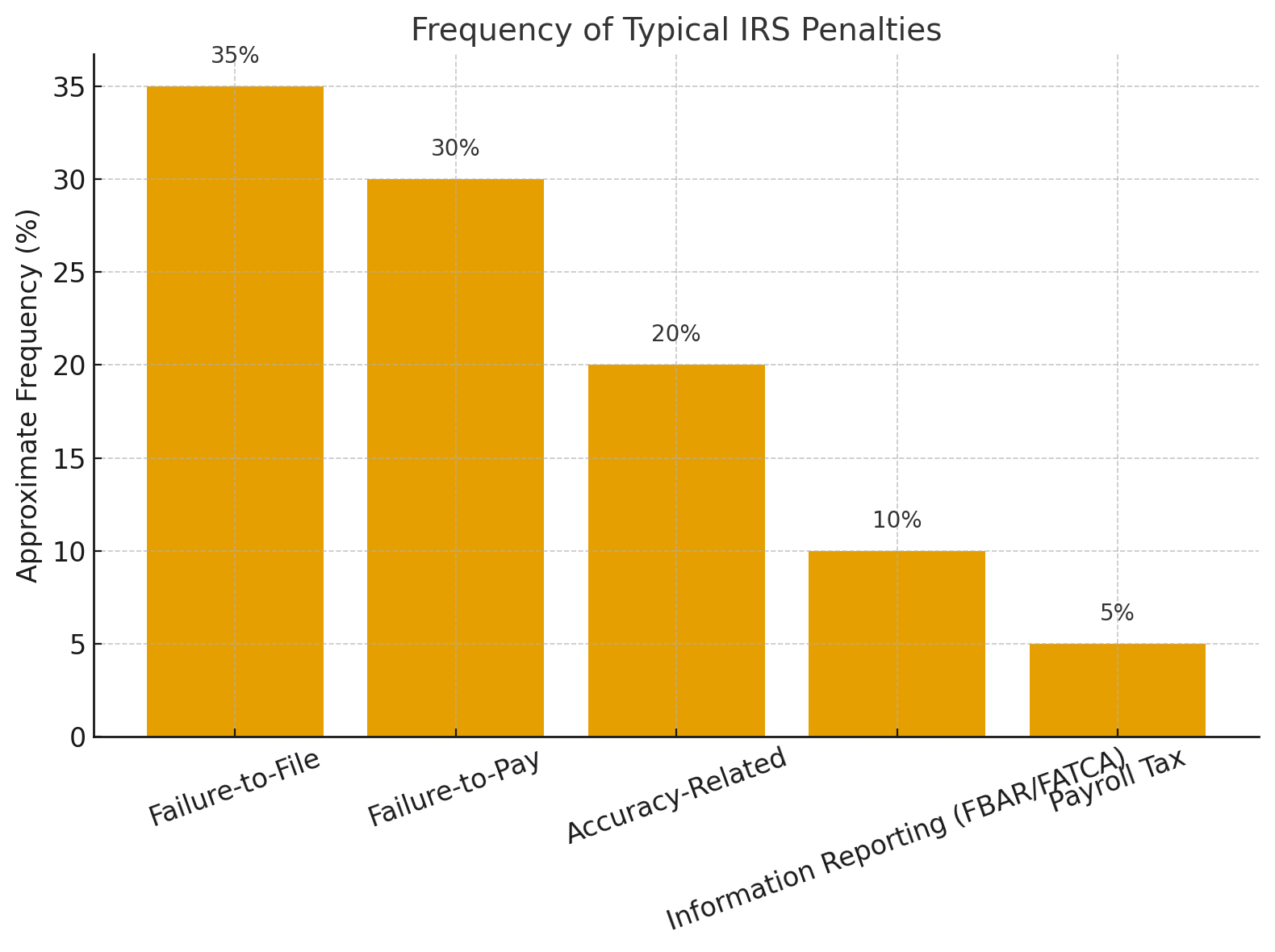

The Most Common IRS Penalties

1. Failure-to-File Penalty

How it works: If you don’t file your tax return by April 15 (or the extended deadline), the IRS charges 5% of the unpaid tax per month, up to 25%.

Example: A taxpayer owed $8,000 and filed 6 months late. The penalty reached $2,000 — in addition to the original tax and interest.

2. Failure-to-Pay Penalty

How it works: Filing on time but not paying triggers a 0.5% monthly penalty, also capped at 25%.

Example: A business filed correctly but delayed paying $20,000 for a year. The penalty grew to $1,200 plus interest.

3. Accuracy-Related Penalty

How it works: If you underreport income or claim deductions incorrectly, the IRS can add 20% of the underpaid tax.

Example: A freelancer reported $60,000 instead of $80,000 in income. After audit, the IRS charged an additional $4,000 in tax plus $800 in penalties.

4. Information Reporting Penalties

How it works: U.S. taxpayers with foreign accounts, assets, or business abroad must file FBAR and FATCA forms. Noncompliance penalties start at $10,000 per account per year.

Example: A family with three bank accounts in Israel forgot to file FBAR for two years. The IRS assessed $60,000 in penalties.

5. Payroll Tax Penalties

How it works: Small businesses that miss payroll tax deposits face heavy fines. The IRS treats unpaid payroll taxes very seriously.

Example: A restaurant delayed payroll tax deposits of $50,000. Within a year, penalties and interest added another $15,000.

How to Reduce or Remove IRS Penalties

The IRS does offer relief, but you need to act quickly:

First-Time Penalty Abatement – available if you filed and paid on time in the past.

Reasonable Cause Relief – medical emergencies, natural disasters, or other circumstances may qualify.

Appeals – you can challenge a penalty if you believe it was wrongly applied.

Practical Steps to Avoid IRS Penalties

Always file on time, even if you cannot pay in full.

Set up installment agreements if you owe taxes.

Keep accurate records of income and expenses.

File required international forms if you have foreign accounts or investments.

Review IRS notices promptly — ignoring them makes problems worse.

Final Thoughts

IRS penalties are stressful, but most are preventable. Even when penalties are assessed, many can be reduced through abatement or appeals. The key is fast action and professional support. If you have received an IRS letter or already face penalties, don’t wait until the balance grows.

📌 Professional guidance in tax compliance and penalty resolution can help you save thousands and restore peace of mind.

🌐 Website: gadzhieva.com

📧 Email: svetlana@gadzhieva.com

📱 Phone: (510) 974-3115

💬 Telegram: https://t.me/Svetlana_CPA

📸 Instagram: @gadzhievacpa

💼 LinkedIn: Svetlana Gadzhieva, CPA

📍 Based in California, available nationwide